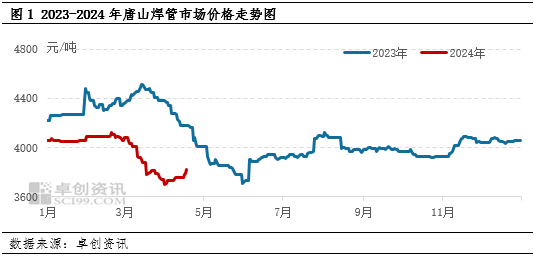

In May, the overall steel market prices showed a fluctuating upward trend. This trend is basically in line with the operating rules of the peak season market. As of May 27th, steel prices have cumulatively increased by 90-100 yuan/ton compared to the end of April, and the increase has narrowed compared to April.

From an analysis perspective, under the continuous stimulus of the bullish policy, supported by factors such as active increase in raw material prices, improved market sentiment, and stable demand follow-up, steel prices have fluctuated and risen. However, it is understood that due to the fact that the overall demand release is less than in April, the price increase has narrowed compared to April.

The main reason for the fluctuation and increase in steel prices in May is that macroeconomic expectations boosted market sentiment, cost increases, and stable follow-up support from terminal demand. Specifically:

In May, the macro positive news was released continuously, and the ultra long term treasury bond and real estate guarantee and interest rate reduction policies were released at the same time, which boosted market confidence, improved market expectations, and provided some support for prices. It is reported that this year’s government work report pointed out that in order to solve the funding problem of major projects and promote the continuous recovery of the economy, it is planned to issue ultra long term special treasury bond for several consecutive years from this year, and it is planned to issue 1 trillion yuan this year. In the middle of May, the 30-year ultra long term special treasury bond will be officially launched. The issuance of ultra long term treasury bond will orderly ease the capital pressure and debt repayment problems, and ensure the advancement of major projects. In addition, the favorable policies for real estate continue to be released. In mid May, relevant policies for real estate were released, and the People’s Bank of China adjusted the interest rate policy for commercial personal housing loans, canceling the lower limit of the national policy for commercial personal housing loans for first and second homes. At the national video conference on effectively ensuring the delivery of affordable housing, a spokesperson stated that in cities with high inventory of commercial housing, the government may order and purchase some commercial housing at a reasonable price for affordable housing. Under the stimulation of multiple macro news, black futures fluctuated and rose, boosting market sentiment and increasing trading activity, driving up steel prices.

In terms of cost, raw material prices actively increased in May, driven by rising costs. After completing the fourth round of increase in coke prices in May, the first round of decrease in coke prices was initiated. As of the time of publication, the price of Tangshan’s quasi first grade coke was 1970 yuan/ton, which remained unchanged from the end of April. Against the backdrop of an increase in discounted production of iron ore, the price of PB powder in Jingtang Port has increased by 2.8% compared to the end of April. At the same time, due to the tight supply of scrap steel, the price has also increased by 4% compared to the end of April. The stable increase in raw material prices has led to an increase in costs, driven by value transmission, which provides strong support for steel prices.

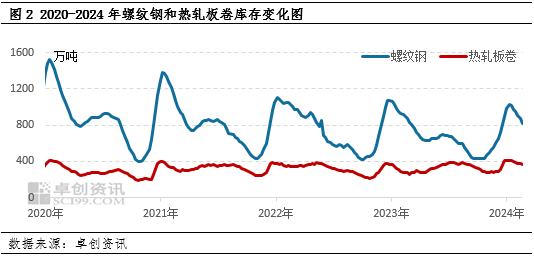

In terms of supply and demand, stable demand followed up in May, inventory resonance decreased, supply pressure eased, and prices were supported. Supported by the release of macro bullish news in May, market trading activity increased. At the same time, May is still the traditional peak season for demand. With policy support, terminal demand has been steadily released, leading to a resonance decline in market inventory. According to research data from Zhuochuang Information, as of May 23, the market inventory of mainstream steel varieties such as construction steel and hot-rolled coils was around 12.14 million tons, a decrease of 2.11 million tons from the end of April. Inventory continued to decline, easing supply pressure and supporting prices.

Looking ahead to the future, in the game of improved market expectations driven by policy support and slower follow-up of actual terminal demand, it is estimated that steel prices in June may weaken after fluctuating operations.

In terms of cost, short-term raw materials such as iron ore and coke may increase in price. At the same time, as steel billets have lower profits and reduced takeout volume, steel billets may become stronger, and cost still provides some support for prices.

In terms of supply and demand, the country will promote the construction of all additional treasury bond issuance projects by the end of June in the later period. It is reported that, of the 15000 projects that have been launched so far, about 11000 have started construction, with the operating rate exceeding 70%. It is expected that the remaining projects will start construction by the end of June. In addition to the implementation and promotion of large-scale equipment renewal and durable consumer goods trade in policy, the terminal demand is still expected to be good. At the same time, the market and corporate inventory are continuing to decline, and the supply and demand environment may still have an improvement trend.However, it should be noted that June is the off-season for demand, and with the arrival of hot and rainy weather, actual terminal demand may show a weakening trend. Insufficient follow-up of high demand will to some extent constrain prices.

In terms of market mentality, the market mentality tends to be cautious. Although expectations have improved under the boost of favorable policies, the lack of follow-up on actual demand still exacerbates the wait-and-see sentiment of merchants. According to a survey conducted by Zhuochuang Information on the future market, a total of 81 samples were surveyed, of which bullish accounted for 23.46%, bearish accounted for 30.86%, and volatile accounted for 45.68%. Merchants mainly purchase on demand, with average price support.

Overall, in the first half of June, with the support of bullish policies, the market still has positive expectations, while raw material prices are relatively strong, and steel prices have some support, which may show a trend of high volatility. In the middle and late stages, as the wheat harvest and rainy season approach, it is difficult for terminal demand to continue to follow up. The weakening of demand will constrain prices, and it is expected that prices may weaken and fluctuate. It is estimated that steel prices in June may show a weak trend after a high level of volatility, indicating a certain risk of weakening.

Source: Xinhua Finance and Economics(https://www.cnfin.com/dz-lb/detail/20240528/4054148_1.html)